how are property taxes calculated in lee county florida

1 be equal and uniform 2 be based on present market value 3 have a single estimated value and 4 be held taxable unless specially exempted. Official Records Deeds Mortgages Easements Liens Maps Plats.

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

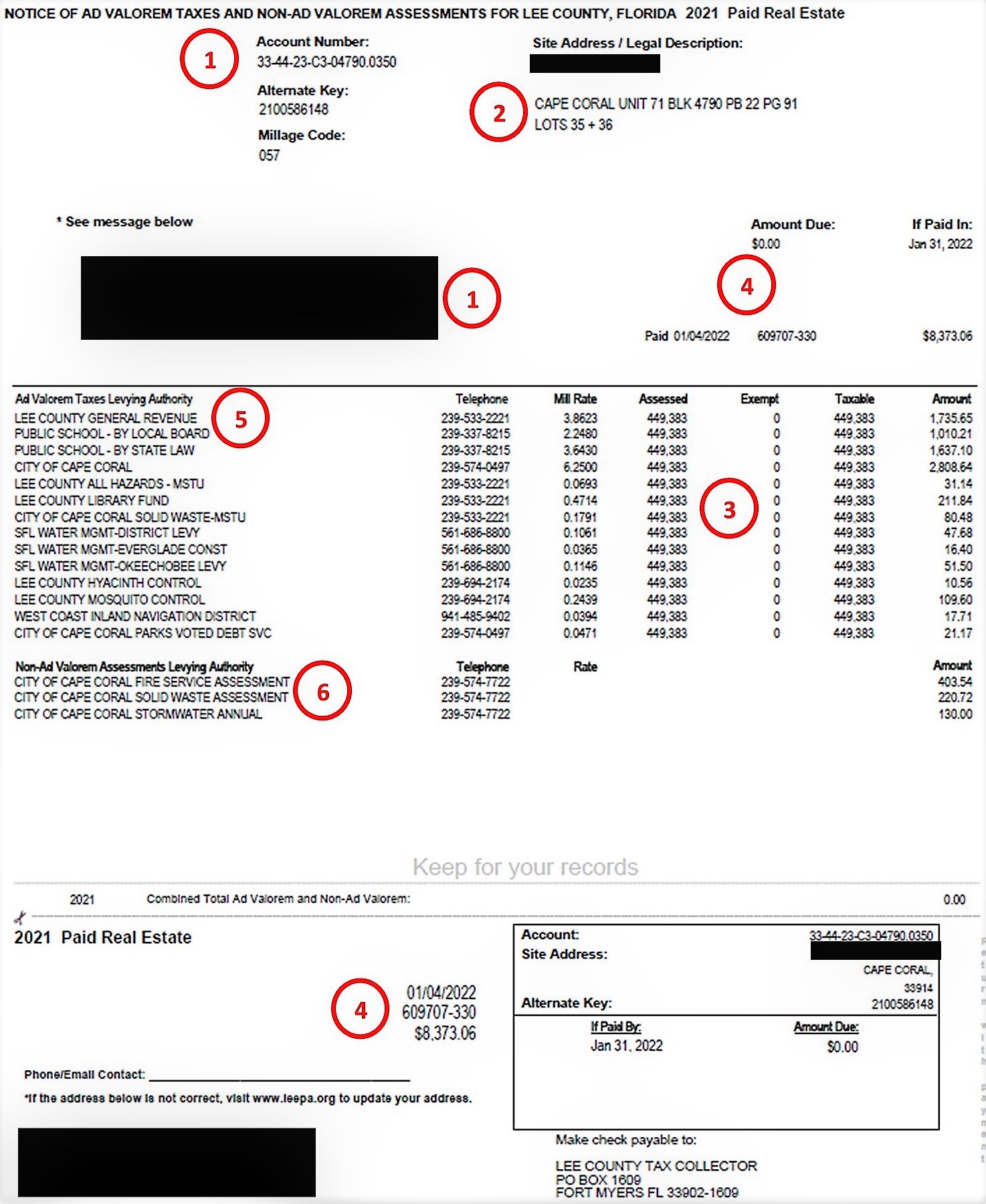

Assessed Value - Exemptions Taxable Value.

. Just Value - Assessment Limits Assessed Value. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any. When it comes to real estate property taxes are almost always based on the value.

Lee County collects on average 104 of a propertys assessed fair market. Unrecorded Plats and Maps. This simple equation illustrates how to calculate your property taxes.

Courts Foreclosure Tax Deed Sales. 100000 this is the available portability amount Percentage. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Foreclosures other real property cases250000. The median property tax also known as real estate tax in Lee County is based on a median home value of and a median effective property tax rate of 104 of. To calculate the property tax use the following steps.

Foreclosures other real property. Find the assessed value of the property being taxed. For comparison the median home value in Lee County.

40 the value difference is 40. Foreclosures other real property cases between 50000-250000. The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600.

Taxation of real property must.

Homeowners In Lee County Hit With Increased Property Tax Bills

New York Property Tax Calculator 2020 Empire Center For Public Policy

Tax Estimator Lee County Property Appraiser

Lee County Property Appraiser Releases Property Value Estimates Fort Myers Florida Weekly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tax Estimator Lee County Property Appraiser

Florida Dept Of Revenue Property Tax Data Portal

The Cost Of Buying And Owning A Property

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Real Estate Property Tax Constitutional Tax Collector

Miami Dade County Fl Property Tax Search And Records Propertyshark

Florida Property Taxes Explained

Current Openings Sorted By Job Title Ascending Career Opportunities

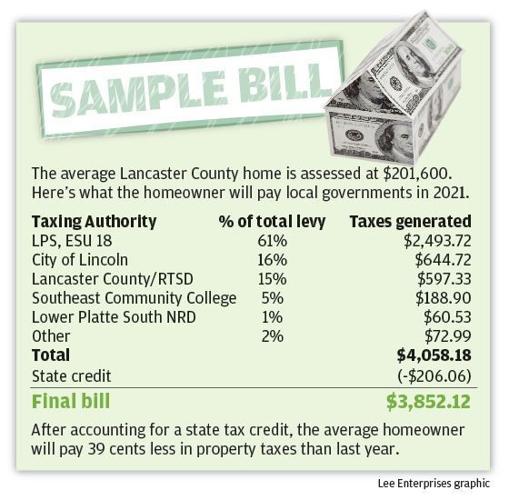

How Much Will You Pay In Property Taxes Next Year Figure Out Your Bill With Our Calculator

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Lee County Florida United States Of America

Region S Property Tax Dollars Go Far For Some Counties Business Observer Business Observer