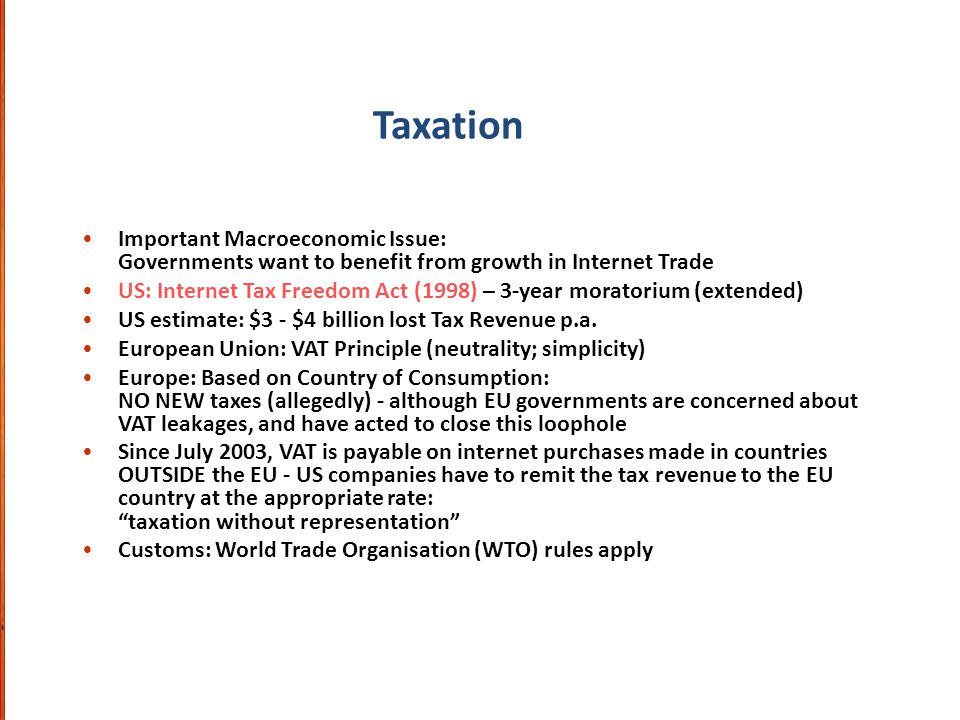

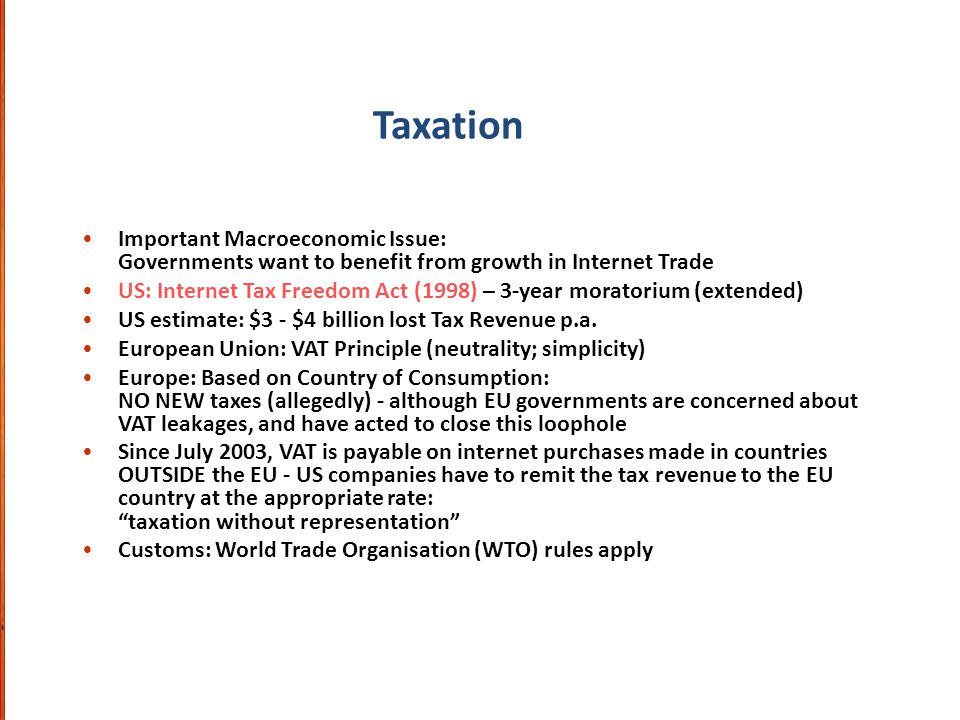

internet tax freedom act 1998

According to the new federal legislation the definition of Internet access includes. 110-108 extended the Internet tax moratorium and the original grandfather clause through November 1 2014.

What Is The Internet Tax Freedom Act Howstuffworks

Internet Tax Freedom Act by United States.

. It was extended by the Internet Tax Nondiscrimination Act and this act extends it again through November 1 2014. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new. John McCain Chairman Committee on Commerce Science and Transportation US.

Preserves State and local taxing authority with respect to income license and sales taxes. 442 the Internet Tax Freedom Act. This Act may be cited as the Internet Tax Freedom Act of 1998.

Internet Tax Freedom Act of 1998 Title XI of the Omnibus Appropriations Act of 1998 Pub. 1054 Introduced in House IH 105th CONGRESS 1st Session H. 4105 Placed on Calendar Senate PCS Calendar No.

Introduced in House 06221998 Internet Tax Freedom Act - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting to collect taxes on Internet access bit taxes or multiple or discriminatory taxes on electronic commerce. Congressional Bills 105th Congress From the US. Government Printing Office HR.

The Internet Tax Freedom Act of 1998 ITFA. To establish a national policy against State and local interference with interstate commerce on the Internet or online services and to excise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would interfere with the free. By Nancy Weil IDG -- The US.

Provides an exception for such. Senate passes Internet Tax Freedom Act. 427 105th CONGRESS 2d Session H.

The Act also established the Advisory Commission on Electronic Commerce. Committee on Commerce Science and Transportation 1998 US. 4105 _____ AN ACT To establish a national policy against State and local interference with interstate commerce on the Internet to exercise congressional jurisdiction over interstate.

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce. Congressional Bills 105th Congress From the US. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus. 1054 To amend the Communications Act of 1934 to establish a national policy against State and local interference with interstate commerce on the Internet or interactive computer services and to exercise. October 9 1998 Web posted at 1125 AM EDT.

Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop charging those taxes beginning. The Internet Tax Freedom Act of 1998 enacted a moratorium on the imposition of state and local taxes on Internet access. The Act placed a three-year moratorium on any new taxes on Internet access fees and prohibited multiple and discriminatory taxes on electronic commerce.

Senate voted Thursday 96 to 2 to approve a bill that places a prohibition on. A AMENDMENT- Title 4 of the United States Code is amended by adding at the end the following. The Internet Tax Freedom Act of 1998 ITFA.

MORATORIUM ON CERTAIN TAXES. CHAPTER 6--MORATORIUM ON CERTAIN TAXES Sec. The Internet Tax Freedom Act Amendments Act of 2007 PL.

The bill contains an intergovernmental mandate as defined in the Unfunded Mandates. Government Printing Office HR. The Congressional Budget Office has prepared the enclosed cost estimate and mandates statement for S.

Internet Tax Freedom Act - Title I. Internet Tax Freedom Act of 1998. Internet Tax Freedom Act by United States.

Advisory commission on electronic commerce. Internet Tax Freedom Act - Prohibits a State or local government from imposing assessing or attempting to collect any tax or fee on the Internet or interactive computer services ICs or on their use. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales.

Committee on Finance 1998 US. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. 1 taxes on Internet access.

What Is The Internet Tax Freedom Act Howstuffworks

India S 1 Trillion Digital Asset Opportunity Crosstower

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Controversial Internet Tax Freedom Act Becomes Permanent July 1

Streaming And Franchise Fees Implications For Communications Infrastructure Troutman Pepper

Ethical Legal And Public Policy Issues In E Business Ppt Download

What Is The Internet Tax Freedom Act Howstuffworks

Constitutional Authorities Under Which Congress Regulates State Taxation Everycrsreport Com

Internet An Overview Of Key Technology Policy Issues Affecting Its Use And Growth Everycrsreport Com

Is A Global Internet Tax Coming In 2021 The Hill

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Michael Mazerov Center On Budget And Policy Priorities

What Is The Internet Tax Freedom Act Howstuffworks

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute